Many of us dream of building wealth, but investing can seem scary for beginners. Yet, with the right strategies, anyone can start building wealth. It’s about making smart choices that fit your goals and how much risk you’re willing to take.

Investing in a mix of stocks, bonds, and real estate can reduce risks and increase returns. This is key to achieving long-term financial success.

Passive income is vital for wealth creation. It lets you earn money without working for it. By investing in assets like rental properties or dividend stocks, you can have a steady income. This can lead to financial freedom.

Financial planning is crucial to make the most of your investments. It helps create a lasting wealth-building strategy. With the right plan, you can start building wealth and reach your financial goals.

SoFi, a well-known online banking platform, offers tools to help beginners invest. You can earn up to a $300 cash bonus for setting up Direct Deposit. Plus, you get 4.00% APY on savings and 0.50% APY on checking balances.

SoFi also insures your deposits up to $250,000 per legal ownership category. They offer more insurance through the SoFi Insured Deposit Program for up to $2 million in deposits.

Key Takeaways

- Investing for beginners requires a solid financial plan and smart investment strategies

- Wealth building is about making smart investing decisions that align with your financial goals and risk tolerance

- Passive income is a crucial aspect of wealth creation, and can be generated through assets such as rental properties or dividend-paying stocks

- Financial planning is essential to ensure that you’re making the most of your investments and creating a sustainable wealth-building strategy

- SoFi offers a range of investment products and services that can help you get started with investing for beginners

- Investing in a diversified portfolio, including stocks, bonds, and real estate, can help mitigate risks and maximize returns

Understanding the Foundations of Wealth Building

Starting your journey to grow your wealth means learning key principles. Setting clear financial goals, building a solid base, and using compound interest are crucial. These steps help you build wealth over time.

Defining Your Financial Goals

First, write down specific and measurable goals. You might want to save for a home, plan for retirement, or grow your investments. Having clear goals helps guide your investment strategies.

Creating a Strong Financial Foundation

A strong financial base includes saving for emergencies, paying off high-interest debt, and making a budget. These actions stabilize your finances. They also help you apply effective wealth building tips.

The Power of Compound Interest

Compound interest is a key to wealth building. By putting your returns back into your investments, your money grows faster. For instance, a high-yield savings account can turn small deposits into big sums over years.

Smart Money Management Principles for Investors

Effective wealth management is key to a secure financial future. By using smart money management, investors can make choices that match their financial goals.

One important principle is diversification. By investing in different types of assets like stocks, bonds, real estate, and commodities, you can lower risk. This makes your portfolio more stable.

- Asset Allocation: It’s important to balance your investments based on how much risk you can handle and your financial goals. This ensures your portfolio is well-rounded.

- Rebalancing: Regularly adjusting your investments keeps your portfolio in line with your goals and the market.

- Long-term Perspective: Focusing on long-term investments helps you stick to your plan, even when the market changes.

- Investment Portfolio Management: Keeping a close eye on your investments helps them perform better and grow.

Starting with financial planning for beginners is a good first step for wealth management. Also, looking into passive income streams can help make your finances more stable and grow over time.

Mastering the Stock Market Basics

Exploring the stock market can be thrilling and profitable. Knowing the basics is crucial for investing wisely and growing your wealth.

Understanding Market Cycles

The stock market goes through ups and downs, mirroring the economy’s natural rhythms. Knowing these cycles is vital for long-term planning and smart choices.

Fundamental Analysis Techniques

It’s important to check a company’s financial health. Look at:

- Price-to-Earnings (P/E) Ratio

- Earnings Per Share (EPS)

- Return on Equity (ROE)

These numbers help figure out if a company might grow and make profits, which is key for managing risks.

Technical Analysis Essentials

Technical analysis looks at price patterns and market signs like:

- Moving Averages

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

These tools spot trends and guide your investment choices based on data.

Using both analysis types and diversifying your investments can lead to a well-rounded portfolio. This approach boosts your chances of long-term success.

The Power of Mutual Funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) are key for portfolio diversification. They help spread investments across different asset classes. This reduces risk and can increase potential returns.

Investing in these funds can bring in passive income from dividends and interest. They also support good asset allocation. This balance is key for strong financial growth strategies.

One big plus is the professional management of mutual funds and ETFs. They keep your portfolio diverse without needing constant checking. For instance, the SPDR S&P 500 ETF Trust (SPY), started by State Street Global Advisors in 1993, is the biggest and most liquid ETF globally.

- Index Funds: Follow specific indexes like the S&P 500.

- Actively Managed Funds: Managed by pros trying to beat the market.

- Sector-Specific Funds: Focus on certain industries like tech or healthcare.

ETFs show their holdings in real-time and are more tax-efficient than mutual funds. Their low fees and the chance to use dollar-cost averaging make them great for financial independence.

By investing regularly and using compound interest, you can grow your wealth over time. Using mutual funds and ETFs in your investment plan is a solid way to achieve long-term financial success.

Real Estate Investment Opportunities

Investing in real estate can help you build wealth over time. It adds variety to your investment mix. Whether you’re starting out or growing your portfolio, there are many options to consider.

Residential Property Investment

Rental properties are a key part of residential investments. They offer a steady income stream. Techniques like House Hacking and Live-In-Then-Rent can help you save on living costs while earning money.

The BRRRR method (Buy-Remodel-Rent-Refinance-Repeat) is another way to grow your wealth through property.

Commercial Real Estate Strategies

Commercial real estate includes office buildings, retail spaces, and industrial properties. These investments can bring in higher returns. They play a big role in building wealth.

When investing, it’s important to understand market demand. Make sure properties are in areas with strong economies.

REITs and Real Estate Crowdfunding

Real Estate Investment Trusts (REITs) let you invest in real estate without owning it. They offer high dividends for long-term wealth. Real estate crowdfunding platforms allow you to invest in bigger projects together with others.

Publicly traded REITs are safer and easier to sell than non-traded ones.

Using these real estate strategies can greatly enhance your investment portfolio. It can help you achieve financial freedom.

15 Smart Investment Strategies to Start Building Wealth Today

Building wealth needs smart investment choices and hard work. By looking into different wealth creation methods, you can find the best wealth building strategies for your goals.

- Invest in diversified index funds to spread risk and maximize ROI.

- Utilize robo-advisors for automated and efficient portfolio management.

- Allocate funds to high-yield savings accounts for steady growth.

- Purchase real estate properties to generate rental income.

- Invest in REITs for exposure to real estate without direct ownership.

- Engage in peer-to-peer lending to earn interest from personal loans.

- Start a dividend investing portfolio for regular passive income.

- Explore mutual funds to benefit from professional management.

- Allocate a portion of your portfolio to bonds for stability.

- Invest in individual stocks with strong growth potential.

- Participate in crowdfunding platforms to support startups.

- Create and sell online courses to generate income streams.

- Develop and monetize a blog or YouTube channel for ad revenue.

- Design and sell custom products through e-commerce platforms.

- Engage in affiliate marketing to earn commissions from referrals.

Using these strategies with good financial planning advice can help you maximize ROI. This way, you can reach long-term financial success.

Passive Income Streams for Long-term Growth

Building wealth isn’t just about working hard; it’s also about creating passive income. These passive income ideas help you stay financially stable and improve your investment plan.

Dividend Investing Strategies

Investing in dividend stocks lets you get a share of a company’s profits often. Big names like Apple and Coca-Cola have a history of paying out dividends. By reinvesting these dividends, you can grow your wealth faster and make your portfolio more diverse.

Creating Multiple Revenue Sources

Having only one income source is risky. Look into different passive income ideas like renting out properties, earning royalties from creative work, or starting an online business. This way, you spread out your risk and make your finances more stable.

Automated Investment Platforms

Platforms like robo-advisors make investing easy with their algorithms. These financial strategies need little effort, letting your money grow steadily. Using these tools can help your investment advice and risk management techniques work better together.

Risk Management and Portfolio Protection

Protecting your investments is key for a secure financial future. Smart money moves help keep your portfolio strong against market ups and downs.

Diversifying is a smart wealth creation idea. By investing in different areas, you lessen the blow of any one investment failing. For instance, mixing stocks, bonds, and real estate can balance risks and rewards.

Tools like stop-loss orders and options can cut down on losses. Stop-loss orders sell a security when it hits a certain price, protecting you from big drops. Options let you hedge against market swings, making your long-term plans stronger.

Insurance, like annuities and long-term care insurance, is also crucial. These products add extra protection, keeping your financial goals on track even with unexpected events.

It’s important to change your risk management as your life changes. Your risk approach should grow with your financial goals and personal life. Finding the right balance between risk and growth is essential for wealth over time.

- Diversify across asset classes and regions

- Utilize stop-loss orders and options

- Incorporate insurance products into your plan

- Adjust strategies based on life changes

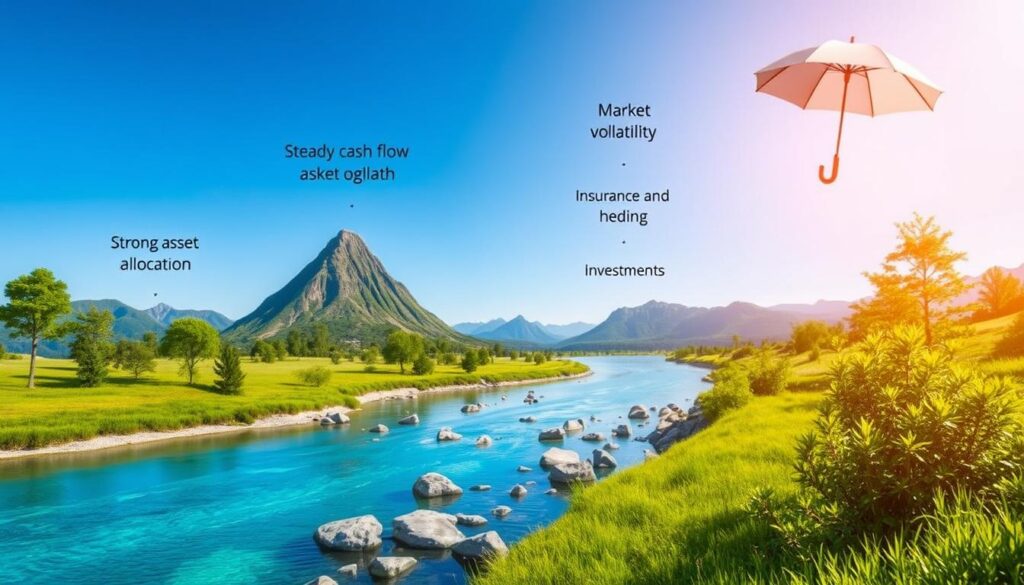

Diversification: The Key to Sustainable Wealth

Diversification is key for long-term wealth building. It means spreading your investments across different types. This helps manage risks and boosts your financial planning strategies.

Smart money management means balancing your portfolio. Include things like equities, bonds, real estate, and more. This balance helps protect against market ups and downs.

Asset Allocation Principles

Asset allocation is central to investment portfolio diversification. It’s about allocating based on your risk level and goals. This makes your portfolio strong against market changes.

Geographic Diversification

Investing in both local and international markets is smart. It exposes you to different economies. This reduces risks tied to one country and opens up global growth chances.

Sector Balance Strategies

Spreading investments across sectors like tech, healthcare, and consumer goods is wise. It lessens the impact of a downturn in one area. This balance is key for steady growth.

Adding passive income strategies, like dividend investing, to a diversified portfolio boosts financial stability. It also supports ongoing wealth growth.

Tax-Efficient Investment Approaches

Managing taxes is key in financial independence planning. High taxes can cut down your investment gains. So, picking investments that lower tax bills is smart.

Using tax-advantaged accounts like 401(k)s and IRAs is wise. In 2025, you can put up to $23,500 in a 401(k) or $30,500 with catch-up. IRAs let you contribute up to $7,000 or $8,000 if you’re 50 or older. These accounts let your money grow without taxes, helping it grow more.

Diversifying your investments is part of wealth management strategies. Investing in municipal bonds, which don’t get taxed at the federal level, is good for those in higher tax brackets. Also, index funds and asset allocation through ETFs can lower capital gains taxes. This boosts your passive income streams.

Strategies like tax-loss harvesting help you offset gains with losses, cutting your tax bill. Placing income-generating assets in tax-exempt accounts and growth assets in taxable ones can also optimize your wealth management strategies.

Retirement Planning and Long-term Investing

Planning for retirement is key to building financial security. Making smart investment choices early can boost your savings over time.

401(k) and IRA Optimization

Optimizing your 401(k) and IRA means picking the right investment portfolio options. Also, don’t miss out on employer matches. Regular contributions and diversifying your investments help meet your long-term investment goals.

Social Security Planning

Adding Social Security to your retirement plan is vital. Choosing the best time to claim benefits can increase your retirement income. This helps in building financial security.

Estate Planning Basics

Having a will or trust is important. It ensures your assets go to the right people, protecting your legacy. Proper estate planning is a key part of long-term investment goals.

- Conservative Allocation: 15% large-cap stocks, 5% international stocks, 50% bonds, 30% cash

- Moderately Conservative: 25% large-cap stocks, 5% small-cap stocks, 10% international stocks, 50% bonds, 10% cash

- Moderate Allocation: 35% large-cap stocks, 10% small-cap stocks, 15% international stocks, 35% bonds, 5% cash

As you near retirement, it’s crucial to adjust your investment portfolio options to lower risk. Creating a sustainable withdrawal plan is also important for a steady income. For more tips on earning passive income, check out this guide.

Advanced Investment Techniques

Want to level up your investment game? It’s time to dive into advanced investment techniques. You’ll need a strong base in financial literacy lessons to get the most out of these strategies.

Options trading, futures contracts, and leveraged ETFs can lead to bigger returns. But, they also come with bigger risks. It’s key to understand these methods for effective money management activities.

Looking into alternative investments like private equity, venture capital, and hedge funds can also help. Adding these to your business strategy management can boost growth while managing risk.

- Factor Investing: Focuses on specific drivers of return such as value or momentum.

- Risk Parity Strategies: Allocate assets based on risk contribution rather than capital.

- Financial Derivatives: Used for hedging or speculative purposes to manage investment exposure.

For a more structured approach, using detailed strategies can make investing easier. Keeping up with finance lessons and a detailed saving money chart are key for tracking and tweaking your investments.

Working with professional advisors can offer valuable insights. They can help navigate the complexities of these advanced techniques. This ensures your decisions align with your financial goals.

Building a Financial Legacy

Creating a lasting financial legacy means your wealth helps future generations and supports important causes. It’s key to have good financial planning strategies for this.

Generational Wealth Transfer

Passing on wealth to your heirs needs careful planning to avoid high taxes. Families like the Rockefellers have kept their wealth by planning well. Using trusts and gifting strategies helps make the transfer smooth.

Charitable Giving Strategies

Philanthropy is a big part of leaving a lasting legacy. You can use donor-advised funds, charitable trusts, and foundations to help causes while keeping your wealth. These methods help you give back while building your wealth over time.

- Donor-Advised Funds

- Charitable Trusts

- Family Foundations

Trust and Estate Considerations

Good trust and estate planning are vital to protect and share your wealth. Using different trust structures lets you manage your assets as you wish. Warren Buffett says it’s important to talk about wills with your heirs to avoid conflicts and ensure your wishes are clear.

Start planning early and keep reviewing your legacy plans to make them work better. Teach your heirs about smart money management and get them involved in giving back. This will help strengthen your wealth building efforts for the long term.

Your Path to Financial Freedom Starts Now

Starting your journey to financial independence is a big step towards a secure future. By using smart passive income strategies, you can earn money without much effort. This way, you create streams of income that work for you all the time.

Diversifying your investments is key to reducing risks and increasing gains. By spreading your money across different types of investments, your portfolio stays strong even when markets change.

Being disciplined in how you manage your investments helps you grow your wealth steadily. Whether you choose to invest in index funds like VTSAX or look into real estate, each choice moves you closer to your financial dreams.

Sticking to these strategies will not only get you financially free but also give you the freedom to live life as you want. Begin by checking your finances, setting goals, and taking steps towards a wealthy future.

Remember, reaching financial independence is a long-term goal. Keep working hard and making smart choices to achieve success.